-

Employing a lawyer to help you with your duty related lawful issues is a major choice. When they’re charging $200-$500 60 minutes, it is to your greatest advantage to guarantee you to pick the ideal individual to handle your issues. Be that as it may, before enlisting an assessment...

-

Investing in a certificate of deposit might be a step in the right direction if you’re feeling like your basic savings account interest rate just isn’t high enough. In exchange for higher interest, the bank or credit union will hold onto your money for longer, and if you withdraw...

-

Establishing a perfect retirement plan should be everyone’s priority. This begins by understanding its essence. Retirement is inevitable. However, life must continue after retirement. Similarly, the value of life should not be demeaning after retirement. Last but not least, responsibilities will always be there after retirement. Therefore, planning for...

-

Buying a car can be a hassle, and auto loans may only complicate the situation further. However, this doesn’t have to be the case if you plan ahead and know what you’re getting yourself into beforehand. Here are some examples of some things to consider before getting an auto...

-

Auto car loans are easy to get if a person has the right credit reputation and the documentation to prove it. A car loan tends to be easier to obtain compared to other loans because the car itself serves as collateral or security on the loan. A person who...

-

If you’re like most people, you’re making monthly payments to some type of installment loan. Sure, the last day you make the payment will be a joyous occasion, but should you pay it off sooner? Does paying off your loan earlier than expected impact your credit score? There is...

-

When it comes to saving for retirement, you want to make the best decisions possible. The worst possible scenario is to end up needing more money after you’ve already retired. Should you take advantage of your 401k or should you invest in an IRA? To better understand these terms,...

-

Simply a collection of stocks and/or bonds, a mutual fund is a company that invests the money belonging to a group of people in stocks, bonds, and other similar things. While these are generally very simple to buy, there’s a lot of planning done beforehand. There are seven different...

-

Opening a merchant account with a credit card processing company allows your small business to diversify payment options for customers. The electronics age is here to stay, and the very fact that the majority of consumers now use plastic cards to make purchases is reason enough to equip your...

-

Wagepoint is a fast, smart and simplified online payroll service for small business application that enables employers and payroll managers in any organization to manage the salaries and wages of their employees and other stakeholders such as suppliers. This computer software is very ideal for small businesses mainly in...

-

Overall Score 85.7 Net Monetary Value 97.8 Product Features 77.8 Customer Experience 47.1 Pros & Cons If you’re a luxury seeker, the Ritz-Carlton Rewards credit card allows you to earn points on stays and purchases within Ritz-Carlton hotels as well as partner hotels (Marriott). You can earn points...

-

Tax relief services can be a great boon to individuals who have got trouble with their taxes. This service offers great assistance especially to tax payers who have due taxes with the Revenue Authority or the IRS (Internal Revenue Service) of their respective countries. These services are usually provided...

-

A lot of misunderstanding surrounds the issue of student loan forgiveness. It is uncertain that you can live out your working life and fail to pay your student loan. Nonetheless, there are ways through which a certain amount of your loan can be forgiven. The discussion in this article...

-

You may not be thinking about it too much now, but good retirement planning starts now! In several years, you will begin a new chapter in the journey of life and it’s never too early to start thinking about it. While many people dread the thought of retirement as...

-

If you’ve found that your cable bill has suddenly blown through the roof, or if the price you originally signed up to pay has become too much, of if you simply want to cut costs on your cable bill, take a look at these tips. Some of these have...

-

Many car buyers are committing a mistake when it comes to financing vehicle purchases because they are deciding on longer loan terms. Car loans with long terms of about six or seven years are becoming common. At some point, you may feel the need to get out of your...

-

If you’ve ever had a car loan, then you’ve had an installment loan. A mortgage loan is another type of installment loan that is quite common. These types of loans are repaid with a set number of scheduled payments. Typically, it includes more than two payments made toward the loan. An...

-

IRA savings accounts offer a means of saving for retirement without having your funds locked up for a particular period of time. The best IRA savings account aims to offer low fees and excellent investing options over a long-term period. Several people misunderstand how an IRA investment works. Many...

-

Dividends are profits that companies share with you if you are a stock shareholder. Dividend mutual funds are stock mutual funds that invest in the companies that pay dividends. Today, mutual funds are a popular investment and something you may be considering. But before investing, you should be aware...

-

Teaching your teenager to use a prepaid credit card can prove to be a difficult task. Nonetheless, a kid with such a card should have some sense of financial independence and understand the basics of managing their own finances without getting into debt. Essentially, it only requires some time,...

-

You’ve probably seen payday loans advertised on television or billboards. High dollar amounts instantly for just a small fee sounds tempting, but you need to know both the advantages and disadvantages to these loan types. Unlike a traditional bank loan, payday loans aren’t based on a credit score, instead...

-

Overall Score 75.2 Net Monetary Value 82.9 Product Features 77.8 Customer Experience 47.1 Pros & Cons The Hyatt Credit Card allows you earn points for spending with Hyatt hotels, restaurants, flights, and everything else you pay for with your card. The points can be redeemed against stays with...

-

Over the years, e-commerce has transformed online purchasing and selling. As technology continues to become a piece of our day by day lives, more people are swinging to the internet to direct businesses. An online store can reach customers anywhere on the planet. Truth be told, online shopping has...

-

A business checking account will allow you to save a lot of time these days. A free checking account can also offer the protecting that you have been seeking for your funds these days because a checking account has many built-in security features. By using an online business checking...

-

Human resource (HR) managers handle the needs of a company’s workforce. They recruit, interview, and hire employees with the help of other company managers, take charge of employee services, ensure that managers follow employment laws, and supervise the work of HR staff. HR managers typically need at least a...

-

After losing employment it is vital to get your finances in order so you can meet your financial obligations. Even without your employment you will still need to pay rent, buy food and pay bills. The situation can be tricky as money is tight and you risk draining your...

-

A car title loan is a fast, easy way to get money using your car title instead of your credit score. When it comes to finding good information for car title loans, the online resources are important. The size of the title loan is normally determined by the amount...

-

Installment loans are perfect for someone who wants to get a student loan, mortgage loan, or auto loan. These are loans that allow you to get what you need and pay off the sum over a set amount of time. Thankfully, these loans are fairly easy to apply for. ...

-

As you grow older, you’ll want to invest your money into an individual retirement arrangement (IRA). These accounts are set up at financial institutions and allow people to save for retirement with tax-free growth. This account is also tax-deferred, which means you won’t be charged taxes on the funds...

-

Mutual funds have become a popular way for shareholders to invest money and diversify their portfolio without a lot of effort. Global mutual funds are collections of securities from all over the world that bring a group of people together to invest, and dividends and interest earn income. Here...

-

Whether you want travel rewards or easier financing terms, it is crucial to have the best credit cards. Notably, the best credit cards on the market today come with plenty of rewards that you cannot get with any other product. Those special rewards can include things like travel insurance,...

-

Unsecured personal loans allows anyone with decent credit to borrow money for most personal needs. The funds borrowed can be used to start your own business, buy personal items, or consolidate your debt. Before obtaining an unsecured loan, be sure you understand how they work and how it can...

-

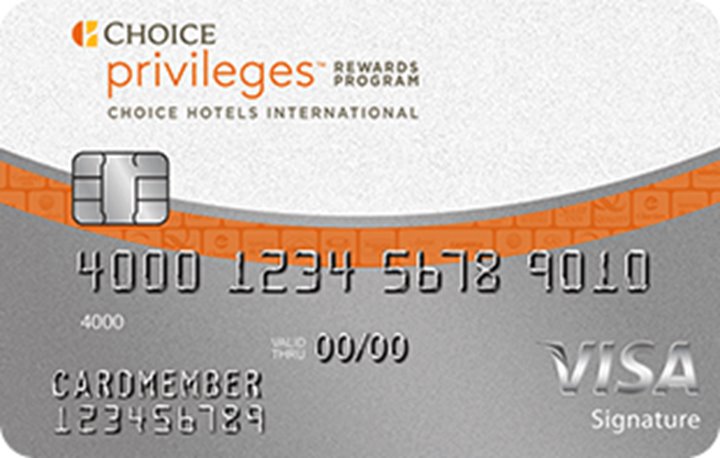

Overall Score 31.7 Net Monetary Value 12.3 Product Features 66.7 Customer Experience 82.4 Pros & Cons If you stay at Choice Hotels you can earn the most points on the Choice Privileges Visa Card, but you can earn points on all purchases also. You can spend your points...

-

Borrowing comes in many forms such as mortgages, personal loans, hire purchase and credit cards. Obtaining loans often appears to be a very fast and easy method of financing your needs, both short term and long term and if proper caution is not taken, it might turn out very...

-

When starting up a company, your advisers will tell you to legally separate your personal finances from the company finances. This separation is one of the most important benefits of early incorporation. Separating yourself from the company legally will protect your personal finances just in case things in the...

-

Joining the military gives you the chance to fight for your country and show your pride, but you can also get incredible financial benefits. Enlisting allows you to go to college for free and so much more. Here is an overview of some of the best benefits you can...

-

Is it better to rent or buy a home based on cost and convenience? The only answer to this is that it really all depends on your financial situation and circumstances in life. However, for most parts, in the long run, owning a home is always much better than...

-

Did you know that most car title loan lenders can only offer car title loans online in a few states? Unlike payday loans, there are several state-specific differences at play when you are looking for the best car title loans. Car title loans online are continually becoming popular ways...

-

Moving after you’ve retired is a no-brainer, but you want to go somewhere new. Why stay within the United States when you could relocate to a foreign city and save money? When you’re living off of Social Security benefits and a retirement fund, you need to stretch your money,...

-

A saving account is an all-inclusive term that includes regular savings account and IRA Savings Account. A Roth IRA refers to a savings account where the earnings accrue on tax-deferred basis but they are tax-free in case distributions are qualified. In regular savings accounts, earnings are normally added to...

-

We have seen massive growth in smartphone sales over the years, leaving people constantly glued to their screens on social media, playing mobile games, or listening to music. Smartphones have had their fair share of criticism, often being blamed for poor social abilities in real life, but we cannot...

-

With our fast paced development in electronics, the majority of people make use of online banking. It’s the fastest and easiest and one can have access to your bank everywhere, like on your smartphones, tablets, notebooks and computers. Due to the easy access we need to protect ourselves from...

-

When seeking sources of credit funding, various factors must be considered. Comparisons must also be made among the different options available. One of the options overlooked by most people is taking a loan from their 401k plan. Two of the most common reasons loans from 401k plans aren’t taken...

-

Overall Score 56.9 Net Monetary Value 48.2 Product Features 66.7 Customer Experience 82.4 Pros & Cons The Barclaycard Arrival Plus World Elite MasterCard is suited for frequent travelers. Cardholders can also earn miles on all purchases which are redeemable for statement credit for qualifying travel purchases including flights,...

-

You might, or might not have heard of the term somewhere, or perhaps you have already engaged in the trade. But the definition of penny stocks has along the years rolled with the dice as far as the stocks market is concerned. Initially, these were small stocks trading for less...

-

So, you want to open up a new business checking account but don’t know the first thing about numbers? Then you’ve come to the right place. You’ve taken the first step; you’ve set up and registered your new small business and now it’s time to sort the finer details....

-

You may end up declaring bankruptcy during a financial crisis, but it shouldn’t be taken lightly. This pros and cons list may help you discover whether filing for Chapter 7 or Chapter 13 bankruptcy is fitting for your situation. Pros of Declaring Bankruptcy Collections Stopped: Filing for bankruptcy stops...

-

We all want to save more without feeling deprived. Fortunately, in this information age, there are hundreds of ways to do it. We’re not talking about the stuff that everybody knows: collecting spare change, cancelling your gym membership and skipping some meals. All we’re talking about are the legitimate...

-

The easier it is for your customer to spend money on your site, the more they’ll spend. Seems simple enough right? Think about it though. If you’re considering making a purchase of a product from a website but you’re not 100% certain yet, the payment process can be a...

-

Studies are showing that income inequality in the U.S. is making it near impossible to make ends meet on minimum wage or raise a family on median wage just about anywhere in the country. Still, sometimes it’s not a financial struggle, it’s your spending habits. Here are some indicators...