-

Do you have a bad FICO® Score? How can you even tell? This list of ten red flags will show you what to look for. 1. You can’t get a credit card. If you’ve had a credit card application turned down, it could be a sign that you have...

-

Homeowners considering refinancing of their properties may qualify for an FHA streamlined refinance loan, cash-out refinance loan, or a no-cash refinance loan. According to FHA loan rules, applicants for a new mortgage must meet the eligibility criteria, not be the same party as the original loan, and reside on...

-

Many people believe, quite mistakenly, that there is no way to reduce mortgage repayments once a deal has been struck with a loaning institution. However, the savviest investors recognize that this is one of the main ways to save money over the long term. Below are just a few...

-

The Home Affordable Refinance Program (HARP) is a federal program for struggling homeowners in the United States. The program was designed in 2009 by the Federal Housing Finance Agency. The agency created the program to help certain debtors refinance their homes without complications. Many people who own homes are...

-

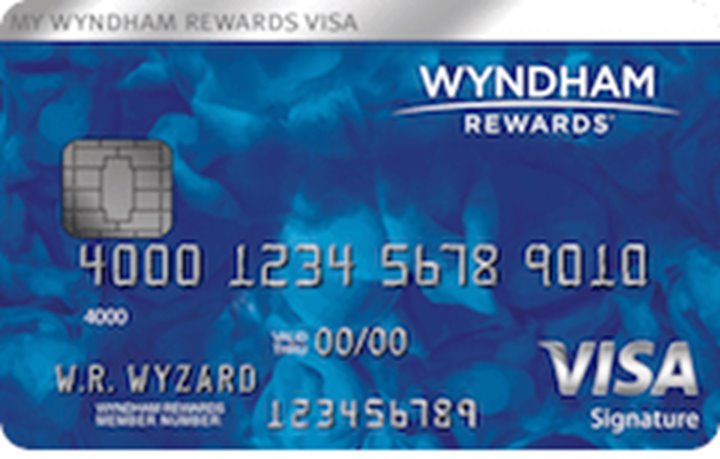

Overall Score 48.6 Net Monetary Value 36.4 Product Features 66.7 Customer Experience 82.4 Pros & Cons For anyone who stays at Wyndham hotels regularly, whether, for business or pleasure, the Wyndham Rewards Visa Signature Card will save you a lot of money. Every purchase you make within the...

-

Overall Score 85.7 Net Monetary Value 97.8 Product Features 77.8 Customer Experience 47.1 Pros & Cons If you’re a luxury seeker, the Ritz-Carlton Rewards credit card allows you to earn points on stays and purchases within Ritz-Carlton hotels as well as partner hotels (Marriott). You can earn points...

-

Overall Score 51.1 Net Monetary Value 53.5 Product Features 77.8 Customer Experience 29.4 Pros & Cons The Wells Fargo Rewards Visa Card does not charge an annual percentage rate on balance transfers and purchases for an introductory period. The cardholders earn points on all eligible purchases. Rewards earned...

-

Overall Score 65.7 Net Monetary Value 55.7 Product Features 66.7 Customer Experience 100.0 Pros & Cons Commerce Bank’s Visa Signature Credit Card rewards cardholders for accumulating interest. Users earn the most cash back for every dollar of interest accrued on their monthly balance, in addition to some cash...

-

Herpes is one of the most prevalent sexually transmitted infections (STIs) in North America. Many are in search of a remedy to prevent recurrent outbreaks. Currently, one cannot cure herpes. The virus that incites the development of herpes can remain inactive within an individual’s system for a long time....

-

The Home Affordable Refinance Program (HARP) is an alternative financing structure that is meant to allow people who are up-to-date on their mortgages to stabilize their home purchase through refinancing. HARP is meant to focus on helping people who are unable to get traditional financing because of the declining...

-

The Home Affordable Refinance Program (HARP) is a U.S. federal program that began in 2009. The goal of the HARP refinancing program is to help struggling homeowners refinance their mortgages. The following is a short history of HARP and how the program continues today. The Crisis After the U.S....

-

A bad FICO® Score is one of those realities of finance that people often forget. It’s too frequently out of sight and therefore, largely out of mind. Nevertheless, once you are saddled with it, it’s a shackle that is hard to shake. You are tied up with bank fees...

-

The Home Affordable Refinance Program (HARP) is an alternative financing structure that is meant to allow people who are up-to-date on their mortgages to stabilize their home purchase through refinancing. HARP is meant to focus on helping people who are unable to get traditional financing because of the declining...

-

The Home Affordable Refinance Program (HARP) is a U.S. federal program designed to help homeowners who are struggling with their current mortgages. Before you apply for refinancing through HARP, you should consider the advantages and disadvantages of this type of loan. Advantages Lower Payments One of the reasons that...

-

More than 75 million U.S. consumers own homes, and many of them have little equity in their homes. Such consumers may want to refinance their mortgages for various reasons, but traditional lenders usually deny refinancing for homes that do not have much equity. The HARP refinancing program allows people...

-

You may be considering refinancing your home for a wide variety of reasons. You may want to switch to a fixed-rate mortgage rather than a variable-rate mortgage. You may be struggling financially and may want to lower your payments or your interest rate. Perhaps you want to perform a...

-

When it comes to determining credit scores, credit risks, and interest rates, FICO® the go-to firm – handling over 10 billion credit requests globally. The FICO® Score is a numerical credit rating that has the power to decide whether a request for borrowed capital is accepted or denied. Likewise, interest...

-

You probably have a vague estimation about your FICO® Score. You guess that you have a good FICO® Score, or a great FICO® Score. Maybe you’re unhappily sure you have a bad FICO® Score. But what, exactly, is a bad FICO® Score? Different Scales, Different Systems The first thing...

-

Refinancing your home mortgage is a major financial decision, but it’s also one that has the potential to save you thousands of dollars over the life of your loan. Refinancing your mortgage can help you to pay less every month, pay your mortgage loan at a faster rate, or...

-

Genital herpes is a widely prevalent sexually transmitted disease that is a result of the herpes simplex virus. Sexual activity is how the virus is primarily transmitted. Following the initial exposure to the infection, the virus remains inactive in the body and can become active numerous times throughout a...